Quick and Reliable Loans

ABOUT US

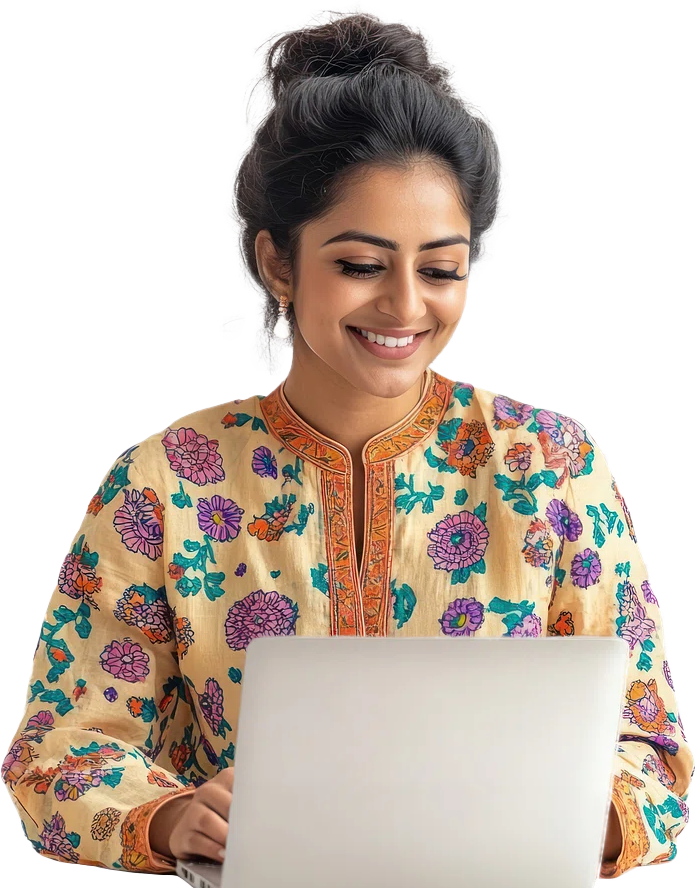

We’re a Trusted and Professional

Personal

Loan Provider

We provide fast and dependable loans to assist you deal with any financial issue with peace of mind, making us your go-to partner in times of need. We are ready to help you at every stage, whether it be with planned investments or unforeseen costs.

Our mission is to improve and revolutionize the online lending procedure for people in need of money. In order to satisfy our customers and uphold our dependability and credibility, we complete the financing process immediately.

-

-

Easy Application Process

-

100% Online Process

-

Safe and Transparent

Our Features

Achieve Financial Freedom with

Quick Loan Approval!

Get Instant Approval

Get Instant Funds with Fast Loan Approval – We're Here to Help!

Quick Disbursal

Loan Disbursal in Just a Few Hours – Always Ready to Serve You!

No Collateral Required

Apply for a Personal Loan – with No Collateral Needed!

Zero Hidden Charges

Your Financial Needs Covered – No Hidden Charges, Just Trust!

Complete Paperless Process

No More Paperwork – Get Your Loan Hassle-Free!

Flexible Repayment

Worry-Free Repayment – Easy EMI Options Just for You!

Our Services

Explore Our Products

For Instant Loans

Instant loans in four

easy steps

-

Online Application

Online application is accomplished with easy and flexible steps, The loan will be approved in 30 min after receiving documents.

-

Document Verification

Document verification for instant loans is fast and secure, requiring basic documents like ID, address, PAN, and income proof.

-

Instant Approval

Once document received, your application is reviewed and approved within minutes using automated systems.

-

Funds Disbursement

Once your application approved then loan amount is transferred directly to your bank account.

Why Choose us

Your Trusted Partner for Instant quick Loans

-

Smart and Easy Borrowing.

Smart and easy borrowing offers a hassle-free loan experience with quick approvals

-

Get Funds Whenever Needed.

Get funds whenever needed with instant loans that provide quick access to money during emergencies or planned expenses.

-

Valuable Customer Support.

Valuable customer support ensures you get timely help at every step of your loan journey.

-

Reasonable Interest Rates

Reasonable interest rates make borrowing affordable, ensuring you get the financial support you need without high repayment burdens.

-

Secure, Hassle Free and User Friendly

Our loan process is secure, hassle-free, and user-friendly—ensuring your data is protected, the steps are simple.

-

No Prepayment or foreclosure charges

Enjoy the flexibility of repaying your loan early with no prepayment or foreclosure charges

Rates & Charges

How is APR determined?

Annual percentage rate (APR) is determined based on your credit score, the amount you wish to borrow and your steady income. Generally, a good CIBIL score calls for a low APR while a poor CIBIL score means high APR. But we have a fixed APR which is the same for all.

Working of Our Rates & Fees

APR reflects the true cost of borrowing money. It includes the annual interest rate, a nominal processing fee and other miscellaneous expenses. APR is usually lower than your credit card interest rate. APR is the actual annual cost of your loan that helps you compare various loan offers from different lenders. We have a fixed APR @ 33.6% per annum.

Monthly Payment Example

| Tenure | Loan Amount | Monthly Interest Rate | Processing Fees | APR | Amount Disbursed | EMI | Total Interest |

| 3 Months | Rs.20000 | 2% | Rs.1000 | 24% | Rs. 19000 | Rs. 6935 | Rs.805 |

Documents Required Eligibility Criteria

DOCUMENTS REQUIRED

- Indian resident

- Salaried Employee

- Above 21 years of age

- Savings Bank Account Holder

- Fair CIBIL Score

- Valid Documents

DOCUMENTS REQUIRED

- Completely filled personal loan application. Indian resident

- PAN Card

- Residence proof – Passport, Driving Licence, Voter ID, Postpaid/Landline Bill, Utility Bills (Electricity/Water/Gas).

- Bank statements for the last 3 months of salary account.

- Salary Slips of last 6 months.